Tired of hassling clients and waiting for late payments? There are some easy steps you can take now to get paid on time and in full.

We hear from many assessors that a common challenge is getting their invoices paid on time. You’re not alone – more than 40% of invoices are paid late, according to bookkeeping software Xero. As a result, business owners are worried about cashflow and even lose productivity.

But it doesn’t have to be that way. Some businesses are skilled at getting the money they’re owed. Rather than waiting weeks or months, they get paid on time and in full.

What’s their secret?

Follow these simple strategies to speed up invoice payments:

1. Put it in writing

Make sure you always have a written agreement with your client before starting work. This should set out the amount to be paid and the timing of the payment. For example, you might agree for your invoice to be submitted and paid prior to releasing the NatHERs report.

Getting this agreed upfront means you’ve managed the client’s expectations around payment, and everyone is on the same page.

2. Invoice as soon as the job’s complete

The sooner you invoice, the quicker you’ll get paid. Whether you give seven days to pay or 30, the countdown doesn’t begin until the invoice is in their hands.

We know invoicing can be tiresome but putting it off only pushes back your payday. This is where bookkeeping software is real time-saver. You can use templates and even send invoices from your mobile, straight after the job is done.

3. Send the invoice to the person paying

Send your invoice straight to the person who makes payment. Otherwise, it will end up in someone else’s inbox never to see the light of day. Better yet, get to know the people who work in your client’s accounts department, so they recognise you are a real business owner, not some faceless organisation. Not sure who to send the invoice too? Ask your client.

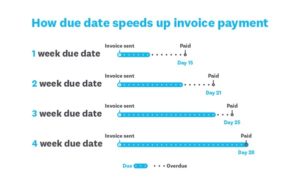

4. Shorten your payment period

Do clients consistently pay late? One trick is to shorten the payment period on invoices. For example, if you currently ask for 30 days, shorten it to one or two weeks. This means even if clients still pay a week late, you’ll have more breathing room than before.

Don’t feel bad about giving short due dates. According to Xero, around 3 in 4 invoices ask for payment within two weeks.

Source: Xero

5. Make it easy to pay

Offer simply payment methods. The easier it is for your clients to pay, the faster you’re like to get paid. Standard options are direct deposit, credit card, EFTPOS and cash. Always include your direct banking details.

6. Make the invoice clear and easy to understand

All client communications should be clear and concise – your invoice is no different. List the details of the job so it makes sense to your client. The good news is bookkeeping software like MYOB and XERO provide templates that help you set out the information in a clear format.

7. Stay organised

Keep track of what you’re owed, the details of a job, and any overdue payments. If you’re racking your brain and struggling to remember the details of various jobs, it’s difficult to provide an accurate invoice.

Spend time setting up an efficient process so you can avoid confusion down the track. Automate as much as possible – that way you don’t need to worry about remembering everything when you’re busy with multiple jobs.

8. Don’t be afraid to chase late payments

We get it – hassling clients for payments can feel awkward and desperate. But it’s essential to prevent late payments in the long run. Most clients have a genuine reason for paying late. But others may take advantage and hold off paying for as long as possible.

The good news? Technology can automate the reminder process. For example, you can set up invoice reminders to be automatically sent at 7- and 14-day intervals after the due date.

If clients don’t respond to the emails, don’t be afraid to pick up the phone. Be firm and stick to your guns.

9. Add late payment fees

It’s a prickly one, but you are allowed to charge late fees or interest on your unpaid invoices so long as it’s clearly stated in the terms and conditions that your client has signed and it was agreed before you provided the service.

Also, the charge must be considered a “fair and reasonable” amount. The best approach is to talk to your accountant or lawyer before adding these to your payment terms.

10. Offer payment plans

If your clients are struggling to pay, and your cash flow allows it, offer to set up a payment plan. After all, being able to collect some income each month is better than nothing at all.

11. Use debt collection

What do you do if a client still won’t pay? This is where debt collection comes into play. You can send a letter of demand or even use debt collection services as a last resort. The latter tells your client that you have reached the point where you need hand the matter to professionals.

In most cases, collection agencies will charge a percentage of the late payments you’re trying to recover. So, as part of your payment terms, be sure to state that any costs associated with recovering the debt will be charged to the client.

If you get all the above right, you shouldn’t need to go down this road. But if you do, make sure you understand what’s involved.

The Bottom Line

The best thing you can do is build a strong relationship with your clients and keep them happy. Happy clients are more likely to pay on time and in full. If you’re not sure how happy your clients are, check out these ways to collect customer feedback.